Blackstone Real Estate AUM: Insights, Growth, and Global Impact

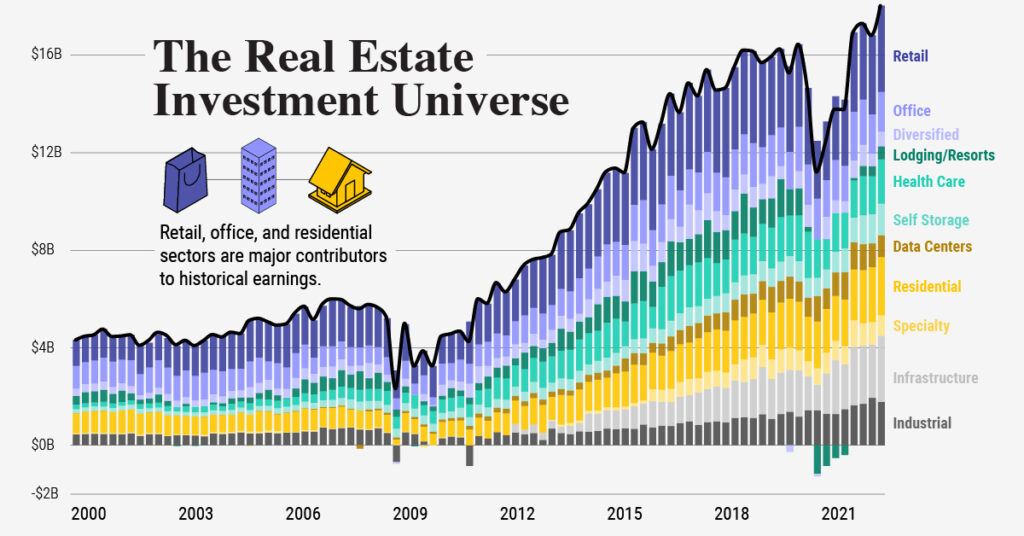

Blackstone is widely recognized as the world’s largest real estate investment manager, with its Real Estate Assets Under Management (AUM) setting benchmarks across the global financial industry. AUM refers to the total market value of assets that a firm manages on behalf of its investors. For Blackstone, this encompasses an immense portfolio of residential, commercial, industrial, and hospitality properties worldwide.

Blackstone’s dominance in the real estate sector highlights the influence of institutional capital in shaping property markets. With billions under management, the firm plays a key role in urban development, infrastructure, and real estate innovation. Investors and industry observers closely watch Blackstone Real Estate AUM figures because they not only reflect the company’s performance but also broader market trends.

Understanding the Scale of Blackstone Real Estate AUM

Blackstone Real Estate AUM has grown steadily since the firm entered the property market in the early 1990s. Today, it spans multiple asset classes, from office buildings and retail centers to logistics warehouses and rental housing. The scale of Blackstone’s AUM underscores its ability to mobilize capital on a global level.

What sets Blackstone apart is not just size, but diversification. Their portfolio includes properties in North America, Europe, Asia, and beyond. By spreading investments across geographies and sectors, Blackstone reduces risks while capturing opportunities in different economic cycles. This level of diversification is crucial in stabilizing returns and maintaining resilience against market volatility.

For investors, the sheer scale of Blackstone’s AUM is a sign of trust and credibility. The company manages funds for pension plans, sovereign wealth funds, and individual investors, making its performance vital for millions of stakeholders worldwide.

Blackstone’s Real Estate Investment Strategy

Blackstone’s strategy in real estate asset management revolves around three pillars: opportunistic acquisitions, diversification, and operational expertise. The firm identifies undervalued or underperforming assets, invests in improving them, and then drives value creation through efficient management.

One notable focus in recent years has been logistics and industrial real estate. With the growth of e-commerce, demand for warehouses and distribution centers has skyrocketed. Blackstone has strategically acquired large logistics platforms across the globe to tap into this trend.

Another aspect of their strategy is hospitality and residential real estate. From hotels to rental housing, Blackstone invests in sectors that align with long-term demographic and lifestyle changes. This forward-looking approach allows them to anticipate shifts in demand and position their portfolio accordingly.

Role of Technology in Managing Blackstone Real Estate AUM

Managing one of the largest real estate portfolios in the world requires advanced technology. Blackstone leverages digital tools to streamline asset management, optimize decision-making, and improve investor communication.

- Data Analytics: Predictive analytics help identify market opportunities and assess risks. By analyzing patterns in property performance, occupancy rates, and consumer behavior, Blackstone can make data-driven investment choices.

- AI and Automation: Artificial intelligence supports property valuations, tenant engagement, and portfolio optimization. Automation reduces manual errors and improves efficiency.

- Sustainability Tech: Green building technologies and energy management systems are integrated into their properties, aligning with global ESG (Environmental, Social, Governance) standards.

Technology not only improves operational performance but also enhances transparency for investors. With real-time reporting and dashboards, stakeholders gain a clearer understanding of portfolio performance.

Real-World Examples of Blackstone Real Estate AUM

Example 1: Logistics Platforms

Blackstone is one of the largest owners of logistics real estate worldwide. Their acquisition of major warehouse platforms across Europe, North America, and Asia demonstrates a strategic bet on e-commerce growth. These facilities support supply chains for companies like Amazon and other retailers.

Logistics assets are vital in today’s economy. By investing in them, Blackstone not only captures strong rental demand but also contributes to the global infrastructure that powers online retail.

Example 2: Hilton Hotels Investment

One of Blackstone’s most famous investments was its acquisition and later exit from Hilton Hotels. Blackstone purchased Hilton in 2007, navigated through the global financial crisis, and eventually took the company public. This deal remains a hallmark example of Blackstone’s ability to manage large-scale hospitality assets.

Through operational improvements and strategic positioning, Blackstone turned Hilton into a highly profitable and globally recognized brand, generating significant returns for investors.

Example 3: Residential Rental Housing

Residential real estate, particularly rental housing, has become an important focus for Blackstone. They have invested heavily in multifamily housing and single-family rental communities.

These assets respond to demographic trends, such as younger generations delaying homeownership. By offering quality rental options, Blackstone taps into a consistent demand driver while addressing housing needs in growing cities.

Example 4: Office and Retail Properties

Despite changes in work patterns, Blackstone remains invested in high-quality office and retail properties, particularly in prime global cities. These assets benefit from location-driven demand, prestige, and long-term tenant relationships.

While the pandemic reshaped the office market, Blackstone’s diversified approach ensures resilience by focusing on properties that attract stable tenants and adapt to evolving workplace trends.

Benefits of Blackstone Real Estate AUM for Investors

The scale and sophistication of Blackstone’s real estate AUM deliver several key benefits:

- Diversification: Exposure across asset types and geographies reduces risks.

- Professional Management: Blackstone’s expertise in acquisitions and operations enhances value creation.

- Liquidity Options: Institutional investors gain access to real estate without the complexity of direct ownership.

- Resilience: Large-scale assets are better positioned to weather market volatility.

- Innovation: Technology integration ensures efficiency and sustainability in property management.

For investors, these benefits create opportunities for stable returns and long-term capital growth, making Blackstone a trusted partner in real estate.

Use Cases: Problems Solved by Blackstone Real Estate AUM

Supporting Pension Funds

Many pension funds rely on Blackstone’s real estate investments to deliver consistent returns. By pooling capital into large-scale properties, these funds secure income streams that support retirees worldwide.

Driving Urban Development

Blackstone’s investments often revitalize neighborhoods by transforming underperforming assets into thriving properties. This contributes to urban renewal, job creation, and improved community infrastructure.

Meeting Global Housing Needs

Through rental housing investments, Blackstone addresses the growing demand for affordable and quality housing in major cities, where population growth and lifestyle shifts increase rental demand.

Stabilizing During Economic Downturns

During financial crises, Blackstone’s diversified portfolio helps stabilize investor returns. By investing across sectors, the firm reduces risks associated with downturns in any single market.

Frequently Asked Questions

1. What does Blackstone Real Estate AUM mean?

It refers to the total market value of all real estate assets that Blackstone manages for its investors, including residential, commercial, logistics, and hospitality properties.

2. Why is Blackstone the largest real estate manager?

Blackstone’s scale, diversification, and investment expertise have positioned it as the world’s largest manager of real estate assets, attracting capital from global institutions.

3. How does Blackstone use technology in real estate management?

They utilize data analytics, AI, and sustainability technologies to optimize operations, improve valuations, and enhance transparency for investors.