Home Equity Investments: Complete Guide, Benefits, and Real-World Use Cases

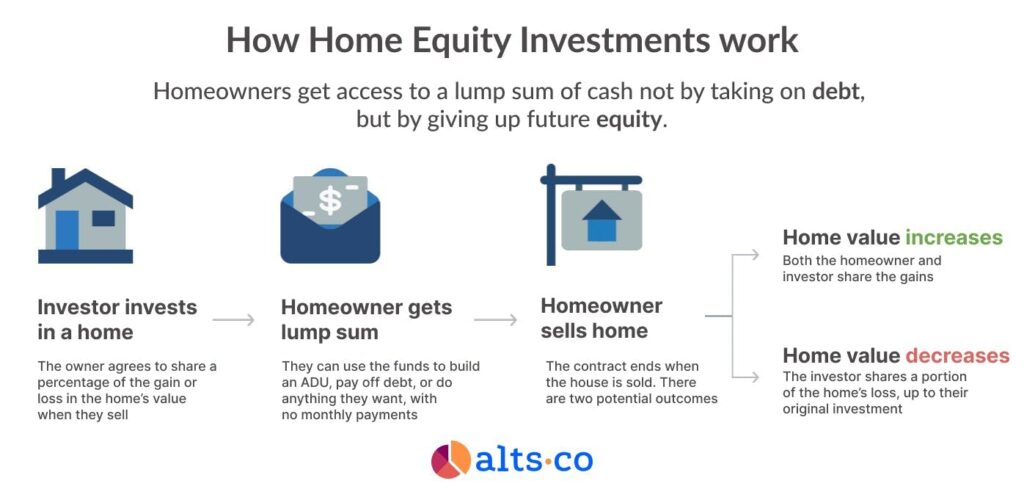

Home equity investments are financial arrangements that allow homeowners to tap into the value of their property without taking on traditional debt, such as loans or mortgages. Instead of borrowing money, homeowners receive a lump sum or structured payment in exchange for a portion of the future appreciation of their property’s value.

This financial tool has grown in popularity because it offers a new way to access home equity without the burden of monthly interest payments. Unlike home equity loans or lines of credit, where repayment begins almost immediately, home equity investments align repayment with the sale or refinancing of the property. This unique structure provides homeowners with flexibility and reduced short-term financial pressure.

How Home Equity Investments Work

Home equity investments are based on a simple principle: a company or investor provides funds upfront in exchange for a share of the future value of a home. The homeowner does not give up ownership but agrees that when the home is sold, refinanced, or after a set period, the investor will receive their original contribution plus a portion of any appreciation.

Key Features of Home Equity Investments

- No monthly payments required during the investment period.

- Funds can be used for almost any purpose: home improvement, debt consolidation, education, or starting a business.

- The homeowner retains full occupancy rights, meaning they continue living in and maintaining their home.

- Settlement typically occurs when the home is sold or refinanced, or after a defined contract term (often 10–30 years).

This makes home equity investments especially appealing for homeowners who are asset-rich but cash-poor. They allow access to liquidity without adding more monthly bills.

Benefits of Home Equity Investments with Technology

The rise of fintech and property technology has modernized home equity investments. By leveraging technology, platforms can now evaluate property values, manage contracts, and offer transparent projections quickly.

Expanded Benefits with Technology

- Data-Driven Valuations

Technology uses real-time property databases, comparable sales, and AI algorithms to assess home value more accurately than traditional methods. This ensures fairer agreements for both homeowners and investors. - Digital Accessibility

Homeowners can apply online, upload documents securely, and receive offers in days. This reduces paperwork, long waiting times, and the stress often associated with traditional financial products. - Transparent Projections

Investment platforms can simulate different future scenarios using interactive dashboards. Homeowners can clearly see how appreciation or depreciation will affect future settlements. - Risk Assessment Tools

Predictive models help identify risks, such as property value decline or regional market volatility, providing both parties with deeper insights before entering agreements. - Long-Term Flexibility

Because technology improves contract customization, homeowners can select terms that best fit their long-term financial plans, whether short-term liquidity or extended occupancy.

Real-World Examples of Home Equity Investment Products

Unison Home Equity Sharing

Unison is one of the pioneers in home equity investment. It provides homeowners with cash upfront in exchange for a percentage of their home’s future appreciation. Unlike loans, there are no monthly payments, and repayment occurs at sale or refinancing.

- Relevance: Unison helps homeowners who want liquidity without traditional debt. For example, a homeowner might use Unison funds to renovate a kitchen, increasing property value while deferring repayment until a future sale.

- Detailed Insight: Homeowners retain full ownership and responsibility for their property. Unison simply shares in the future gain or loss, aligning incentives between investor and homeowner.

Point Home Equity Investment

Point provides upfront funding by investing in a share of a homeowner’s property value. Its contracts typically last 10 years, after which homeowners can buy back the investment or sell their home.

- Relevance: Ideal for homeowners who need immediate funds for debt consolidation or tuition costs but don’t want loan repayments.

- Detailed Insight: Point uses advanced algorithms to calculate home value and simulate possible future scenarios, giving homeowners a clear understanding of potential outcomes.

Hometap Equity Partners

Hometap offers a streamlined digital platform for accessing home equity. Homeowners receive cash upfront in exchange for a share of the property’s future value appreciation. Contracts usually last 10 years.

- Relevance: Hometap appeals to families needing funds for major expenses like medical bills or business investments while maintaining homeownership.

- Detailed Insight: The platform provides an interactive dashboard showing projected obligations based on different appreciation rates, which empowers homeowners to plan better.

Unlock Home Equity Solution

Unlock is another fintech platform specializing in home equity investments. It offers flexibility in how funds can be used, from improving a property to building financial security.

- Relevance: Particularly useful for homeowners in rapidly appreciating housing markets who want to tap into equity without selling.

- Detailed Insight: Unlock emphasizes homeowner education, providing calculators and scenario planning tools to ensure homeowners make informed decisions.

Noah Home Equity Platform

Noah provides homeowners with upfront cash in exchange for a portion of their home’s future appreciation. Contracts generally last 10 years, with no monthly payments.

- Relevance: Noah targets homeowners who may not qualify for traditional loans but still want to access liquidity from their property.

- Detailed Insight: The platform evaluates property value trends at a regional level, helping determine a fair agreement for both parties.

Practical Use Cases of Home Equity Investments

Debt Consolidation

Homeowners facing high-interest debt can use home equity investments to pay off balances. By replacing expensive debt with equity-based liquidity, they reduce financial pressure and improve cash flow.

Home Renovations and Improvements

Upgrading kitchens, bathrooms, or adding energy-efficient features often requires significant funds. Home equity investments provide cash for renovations without immediate repayments, while improvements can further increase property value.

Funding Education

College tuition or advanced training can be financed through home equity investments. Families gain access to funds without jeopardizing monthly stability, as repayment is deferred.

Medical Expenses

Unexpected medical costs can strain households. Home equity investments offer quick access to substantial funds while allowing homeowners to focus on recovery instead of financial stress.

Starting a Business

Entrepreneurs can use their home equity as seed capital without resorting to high-interest loans. This provides liquidity to launch ventures while preserving ownership of their homes.

Why Home Equity Investments Are Useful in Real Life

Many homeowners are “house rich but cash poor.” They have significant property value but limited liquid savings. Home equity investments bridge this gap by turning a portion of home equity into usable funds without forcing a sale.

For retirees, this can mean additional income to enjoy retirement. For young families, it might fund education or home upgrades. For entrepreneurs, it unlocks capital without traditional lending hurdles.

This flexibility makes home equity investments a valuable financial tool across multiple life stages and scenarios.

Conclusion

Home equity investments represent an innovative financial solution that allows homeowners to unlock the value of their property while avoiding the rigid repayment structures of traditional loans. By using technology-driven platforms, the process has become more transparent, accessible, and efficient.

With real-world providers like Unison, Point, Hometap, Unlock, and Noah, homeowners now have more options than ever to transform property value into practical resources. From debt relief and education to renovations and entrepreneurship, home equity investments provide versatile solutions for diverse financial needs.

FAQ

1. How are home equity investments different from home equity loans?

Home equity loans require monthly repayments with interest, while home equity investments provide cash upfront with no monthly payments. Repayment occurs when the home is sold, refinanced, or after a set term, often based on the property’s appreciation.

2. Are home equity investments risky?

Like all financial products, risks exist. If property values fall, homeowners may owe less, but if values rise sharply, they share a portion of the gain with investors. The key is understanding contract terms and long-term implications.

3. Who should consider home equity investments?

They are best suited for homeowners who need liquidity but either cannot or do not want to take on traditional debt. Retirees, entrepreneurs, or families facing large expenses often benefit from these options.