How to Find Real Estate Investors: Proven Strategies & Examples

In real estate, capital is often the biggest constraint. Whether you’re a developer, a deal sponsor, or someone looking to scale portfolio investments, knowing how to find real estate investors is vital. But finding the right investors, ones who understand markets, trust your track record, and move capital, requires deliberate strategy, relationship building, and smart positioning.

This article will explore in depth the process of locating real estate investors. We’ll explain key principles, showcase examples of investor platforms or strategies, describe how technology can amplify your outreach, outline use cases (what problems this solves), and end with FAQs to clarify common questions.

The Foundations of Finding Real Estate Investors

Understanding What Investors Seek

Before you reach out, it’s critical to understand what investors look for. Most real estate investors evaluate:

- Track record and credibility: prior deals, success metrics, or proof you deliver

- Deal structure clarity: clear business plan, capital stack, projections, and exit strategies

- Risk mitigation: how risks are handled (due diligence, reserves, market stress tests)

- Returns: expected IRR, cash-on-cash returns, distributions

- Alignment of interests: sponsor/investor alignment, fees, control, governance

If you approach investors without these items well-defined, many will dismiss your proposition before deeper engagement. To find serious investors, you must present professional, structured offers, not vague ideas.

Types of Real Estate Investors You May Target

Not all investors are the same. Your outreach should reflect the type you need:

- Private individual (accredited) investors: local or national individuals with capital and willingness to back deals

- Institutional investors: pension funds, insurance companies, endowments these demand larger scale, governance, and transparency

- Real estate funds or syndicators: groups or platforms pooling capital and investing in deals

- Crowdfunding platforms: where many small investors participate in property deals

- Family offices: high-net-worth family-run investor vehicles, often with flexible mandates

Each type has different expectations, capital thresholds, and decision processes. Tailor your approach accordingly.

Methods & Channels to Locate Investors

In-Person Networking, Clubs & Meetups

One of the most effective ways to find real estate investors is through networking groups, local real estate investment (REI) clubs, or meetups. These are places where serious investors gather, share deals, and look for sponsors.

By regularly attending these meetings, you build trust, grow your name among active investors, and may uncover leads. As one article suggests, showing up consistently in such circles helps you develop relationships that lead to capital.

Another approach is to start or host investor events (dinners, pitch nights, roundtables). If you can position yourself as a valuable host or content contributor, investors will naturally gravitate toward you.

Public Records & Real Estate Data Sources

You can learn who invests locally by mining property records, transaction data, and investor registries. Public county records show property ownership and sometimes LLC names or names of repeat investors. From there, you can research or reach out to those names.

There are also real estate databases (e.g., property research tools) that list owners, foreclosures, sales history, and portfolios. Using such systems helps you spot investors who already own multiple properties or are active in your target market.

Online Platforms & Syndication Channels

Modern platforms have made investor sourcing more scalable. For example:

- Real estate crowdfunding portals connect sponsors and investors

- Syndication platforms allow accredited investors to back specific property deals

- Online investor directories or matching services

- Social media groups (LinkedIn real estate groups, Facebook REI communities)

One guide recommends sharing market insights, success stories, and content to attract investor interest over time, rather than cold outreach alone.

Content Marketing & Thought Leadership

This is a longer-term but highly effective channel. By publishing valuable content (articles, market reports, case studies), you build credibility in the real estate investment community.

When investors see your thought leadership and expertise, they may approach you. One article on creating content to attract investors stresses consistent value-first messaging, aligning content with investor needs, and choosing the right formats.

Real Estate Conferences & Industry Events

Large-scale conferences bring together sponsors, investors, capital providers, and dealmakers. Attending these allows you to pitch, network, and meet capital allocators in person.

Be prepared: conferences are competitive, so you need clear marketing, an executive summary, and the ability to follow up effectively. Use those events as catalysts to deepen your investor pipeline.

Examples of Investor Platforms & Models

Below are real-world platforms or models that facilitate finding and working with real estate investors.

Example 1: Patch of Land Crowdfunding Marketplace

Patch of Land is a peer-to-peer real estate crowdfunding platform. It connects property developers and sponsors needing short- to medium-term financing with investors seeking yield from real estate debt.

For someone looking to find investors, listing a project on such a platform gives exposure to a pool of capital. You gain access to debt or equity investors who evaluate your deal via the platform’s vetting process. It’s a way to reach multiple smaller investors through one interface rather than individually sourcing each investor.

Example 2: Private Real Estate Syndication (Equity Partnerships)

In syndication models, a sponsor structures a deal (e.g., multifamily property) and invites accredited investors to take equity shares. The sponsor handles execution, management, and operations; investors provide capital and share in returns.

This model is common in value-add multifamily and allows sponsors to leverage investor capital beyond their own. Many sponsors use platforms, direct outreach, and networking to find participants for their syndications.

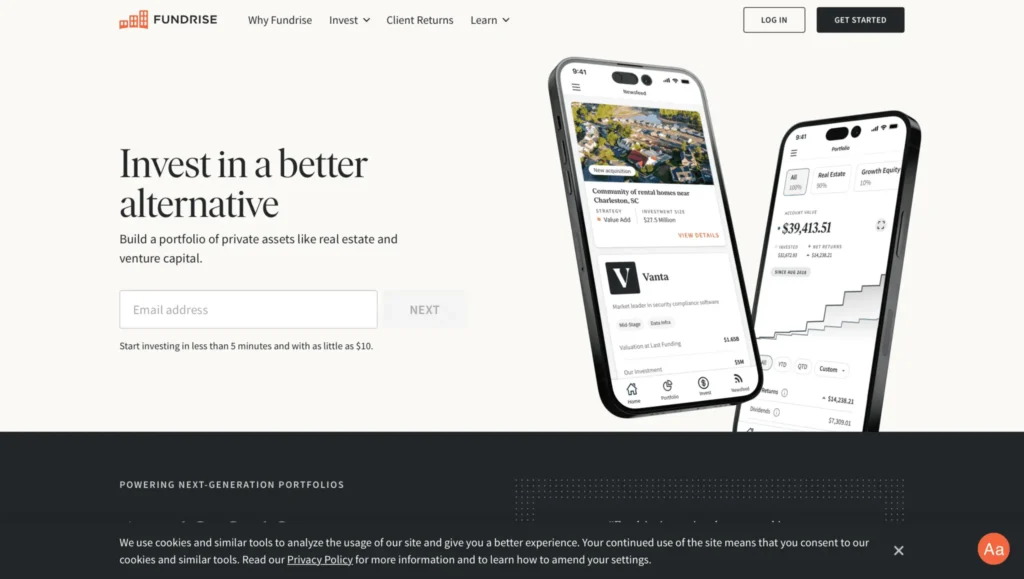

Example 3: Real Estate Crowdfunding Platforms & Marketplaces

There are platforms where sponsors submit deals and investors review them. These platforms may include minimum investment thresholds, due diligence, and legal structuring. As an example, Wealth Migrate (a real estate marketplace) allows users to invest in residential or commercial properties globally.

Such platforms amplify reach: instead of local investor networks, you can attract capital from investors across geographies. It reduces friction in matching deals to capital.

Example 4: Traditional Private Equity Funds / Institutional Capital

Larger-scale deals often use institutional capital or private equity funds. In this model, you approach fund managers, real estate investment trusts, or institutional investors with structured proposals for co-investment.

While harder to access, institutional capital brings scale and deeper resources. Having a strong track record, governance, financial modeling, and transparency is essential to engage these groups.

Benefits of Using Technology to Reach Investors

Technology plays a pivotal role in scaling investor outreach, vetting, and relationship management. Below are detailed benefits and ways technology helps.

Efficient Outreach & Automation

With CRM systems, automated email campaigns, and investor portals, you can manage outreach at scale. Rather than cold calling one investor at a time, you can segment your audience, nurture them via drip campaigns, and track engagement metrics (opens, clicks, responses).

Automation reduces manual effort, ensures follow-ups, and helps convert casual interest into deeper conversations.

Enhanced Due Diligence & Transparency

Online portals allow you to upload deal documents, financial models, property reports, and due diligence materials securely. Prospective investors can access information, ask questions, and review performance metrics in real time.

This transparency builds trust and speeds up investment decisions. Technology enables back-and-forth due diligence without endless email chains.

Matching & Discovery Algorithms

Some investor marketplaces use matching algorithms to pair sponsors with investors whose preferences align (e.g., geography, asset class, risk tolerance). This helps filter prospective investors who are more likely to invest rather than sending mass outreach indiscriminately.

Matching reduces wasted effort and increases the probability of successful capital raises.

Virtual Events & Online Pitching

Technology supports webinars, virtual investor meetings, and hybrid events. You can present deals to remote investors without travel. Virtual pitch rooms, digital Q&A sessions, and recorded investor sessions expand your geographic reach.

Data Analytics & Investor Scoring

Using analytics, you can score which investor outreach performs best—such as which investor segments respond more,whicht email subject lines convert, or which geographic zones yield more capital. Over time, you refine your approach based on data rather than guesswork.

Use Cases: Why Finding Real Estate Investors Matters

In this section, we explore real-life problems that a well-executed investor acquisition strategy solves and why it is useful.

Use Case 1: Scaling from One-Off Deals to a Growth Platform

A developer who sources one property at a time may struggle to grow. By systematically finding investors, they can turn deal flow into a scalable business. Each new investor relationship supports more deals, helps diversify acquisition risk, and allows parallel projects.

Use Case 2: Filling Capital Gaps When Lenders Pull Back

Real estate cycles mean that debt financing can tighten during downturns. Sponsors who already have investor relationships can tap equity or private capital to fill gaps in financing, bridging deals that otherwise might stall.

Use Case 3: Diversifying Investment Vehicles

Developers or sponsors often wish to offer different investment products: debt, preferred equity, or joint venture equity. Having a network of investors allows you to match different types of capital to appropriate structures, rather than being limited to a single model.

Use Case 4: Risk Sharing & Co-Investment

Large deals often require substantial capital. By finding multiple investors, you distribute risk. Each investor takes a portion, reducing exposure. Co-investment also builds credibility when others commit, new investors may feel more comfortable joining.

Use Case 5: Shortening Fundraising Cycles

In deals, time kills deals. Rapid access to investor capital shortens fundraising cycles. If you already have a list of prospective investors and relationships built, you reduce friction and raise capital more quickly when opportunities arise.

Tips & Best Practices for Success

- Maintain consistent communication and value: even when you’re not raising capital, publish market insights, status updates, or occasional project reviews to stay on investors’ radar.

- Segment and customize messaging: tailor pitch decks or outreach to investor types some prefer debt deals, others equity, others short-term or long-term.

- Vet carefully: screen for investors’ financial capability, alignment, timeline, and professionalism. Not every lead is a good partner.

- Build trust with governance: provide clear transparency, regular reporting, third-party audits, and investor protections to reduce perceived risk.

- Leverage testimonials and track record: early successes, even small ones, help establish credibility investors look for proof.

- Always request referrals: satisfied investors often refer others, expanding your network organically.

Frequently Asked Questions (FAQ)

Q1: How many investors do I need for one real estate project?

There is no fixed number. A project might use a handful of large investors or dozens of smaller ones. The key is reaching your funding target, diversifying risk, and ensuring that investor management remains feasible.

Q2: Can I find real estate investors without prior deals oa r track record?

Yes, though it is harder. Focus on smaller deals, show deep market knowledge, build relationships over time, and offer transparency. You may need to start with local investors, friends/family, or co-invest with experienced partners to build a track record.

Q3: What are the key red flags when vetting real estate investors?

Red flags include investors unwilling to share their credentials or financial capacity, lack of clarity on decision timelines, excessive demands on control beyond typical terms, reluctance to sign legal agreements, or inconsistency in commitment.