Private Real Estate Funds: Complete Guide to Structure, Strategy & Examples

Private real estate funds are a powerful and sophisticated mechanism by which investors pool capital to acquire, manage, and eventually dispose of real property. They combine the scale of institutional capital with the value creation of real estate operations. In this article, we will examine what private real estate funds are, how they are structured, different strategies, real examples, the role of technology, benefits and challenges, real-life use cases, and a set of frequently asked questions.

What Are Private Real Estate Funds and How They Operate

Definition and Core Characteristics

Private real estate funds are collective investment vehicles where capital from multiple investors is pooled and managed by a general partner or fund manager. The pooled capital is invested in properties or real estate-related ventures. These funds are not publicly traded like REITs, and their investments tend to be illiquid for longer durations.

Key characteristics include:

- Use of a limited partnership or limited liability company structure, where investors (limited partners, LPs) provide capital and the manager (general partner, GP) makes decisions.

- Often, closed-end or open-end formats; many are closed-end, given the illiquidity of real estate assets.

- Capital is deployed over time via capital calls rather than all at once.

- Profit allocation often follows a waterfall structure (return of capital to investors, preferred return, then split of residual profits).

- Emphasis on direct property ownership or control, often involving value-add, redevelopment, or repositioning efforts.

These funds are appealing to institutional investors or accredited individuals who accept longer time horizons in exchange for potentially higher returns and control.

Strategic Types and Investment Approaches

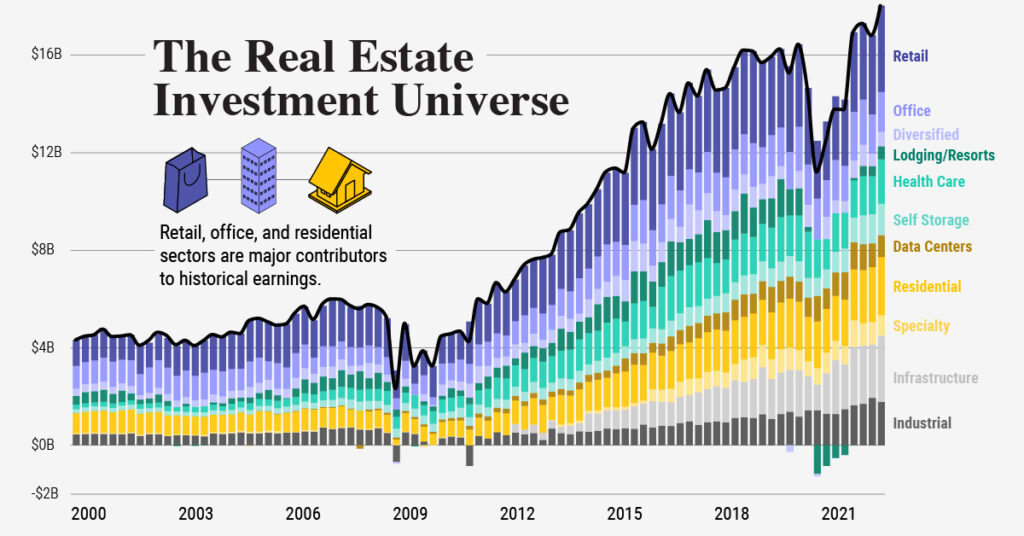

Private real estate funds adopt different strategies depending on risk tolerance, yield targets, and time horizons. Some of the common strategies include:

- Core: Investing in stable, income-producing properties in prime locations with low leverage. Lower risk/return.

- Core-Plus: Similar to core but with potential for light upgrades or operational improvements. Moderate risk.

- Value-Add: Acquiring underperforming or below-market properties and improving them (renovation, repositioning) to increase cash flow. Higher risk/return.

- Opportunistic: More aggressive, including new development, major redevelopment, or distressed assets. Highest risk/return profile.

- Credit / Real Estate Debt: Some funds focus on providing or investing in mortgage loans, mezzanine debt, or real-estate-backed credit instruments rather than equity.

Funds may specialize further by geography (emerging markets, U.S. markets, Asia, etc.), asset class (industrial, multifamily, office, retail, mixed use), or even by themes (logistics, data centers, life sciences).

Because real estate is illiquid, fund designers match the liquidity demands of investors with the investment term, often locking in capital for 7 to 12 years or more.

Real-World Examples of Private Real Estate Fund Vehicles

Here are several real-world instances or fund concepts that help illustrate how private real estate funds operate in practice.

Example 1: PGIM Private Real Estate Fund

PGIM offers a private real estate fund structured with a tender-offer mechanism, allowing some liquidity windows for investors under certain conditions.

Notably, PGIM is a large real estate asset manager, giving scale and pedigree to this fund. Its fund provides access to private real estate opportunities with professional management and periodic liquidity, which bridges some of the typical trade-offs of private funds.

This example shows how large institutional managers structure private real estate offerings to appeal to institutional or high-net-worth investors, balancing liquidity, yield, and deployment of capital.

Example 2: Patron Capital (European Opportunistic Real Estate Fund)

Patron Capital is a European private equity real estate fund manager focusing on opportunistic and value-oriented real estate investments across Europe.

Patron typically targets distressed or undervalued property assets, property-related loans, or redevelopment opportunities. It invests across many European markets and often with co-investments or joint ventures.

This shows the opportunistic side of private real estate funds: taking on more complexity and risk for the chance of outsized returns in challenging or transitional markets.

Example 3: Private Real Estate Funds in Market (PERE Trackers)

PERE, a major private real estate analytics platform, tracks the largest private real estate funds currently in the market by target size, strategies, and geographies.

These tracked funds often raise multiple billions of dollars and represent large institutional efforts to deploy capital into real estate worldwide. The presence of these mega-funds demonstrates both demand and scale in private real estate investing.

Using such trackers, prospective investors or fund sponsors can monitor who is raising funds, the strategies in vogue, and competitive benchmarks for fund size and terms.

Example 4: Liquid Realty Partners (Secondary Private Real Estate Interests)

Liquid Realty Partners was a firm that operated in the secondary market for private real estate funds. It purchased interests in existing real estate funds, joint ventures, and partnerships.

By buying fund interests, it provided liquidity to investors wanting early exits and gave new investors access to mature assets. This model highlights a different angle: the secondary trading of private real estate positions, not just primary capital raising.

Though Liquid Realty is no longer active, its strategy demonstrates how private real estate fund interests can trade.

Example 5: Unico Properties (Private Equity Real Estate Operator)

Unico Properties is a U.S.-based private equity real estate investment and development company that manages a large real estate portfolio. While not a pure fund structure as in a “closed-end fund,” it functions similarly by acquiring, managing, and developing real estate with investor capital.

Unico invests in high-quality office, residential, and mixed-use projects, primarily in the Pacific Northwest and western U.S. Their model shows how private real estate capital can be deployed in a regional climate and tailored development strategy.

Each of these examples reveals different fund models, strategy alignments, and levels of transparency or sophistication.

Technological Role & Innovation in Private Real Estate Funds

While real estate is traditionally viewed as a low-tech, physical asset class, technology is playing an increasingly important role in private real estate fund operations and investor experience.

Enhanced Deal Sourcing & Underwriting

Fund managers now use data platforms, AI, satellite imagery, and market analytics to identify acquisition opportunities faster and more efficiently. These technologies allow managers to screen property markets, compare valuations across submarkets, optimize due diligence, and model projections with better precision.

With access to large datasets on rents, vacancy, property condition, and local economics, funds can underwrite deals more reliably and reduce surprises post-acquisition.

Digital Investor Portals & Transparency

Modern private real estate funds often provide digital portals where investors can monitor capital calls, distributions, performance metrics, property-level data, valuations, and risk analytics. This transparency helps build trust and gives investors clarity into what the fund is doing in near-real time.

By offering dashboards, reporting modules, and communication tools, funds reduce manual paperwork, speed communications, and improve investor relations.

Workflow Automation & Capital Deployment

Internally, fund operations benefit from automation in tasks such as:

- Managing capital call notices and tracking investor commitments

- Automating disbursements to property acquisitions, development milestones, or vendor payments

- Document workflows and compliance checks (e.g., KYC, anti-money laundering)

- Accounting, audit trails, expense allocations, and reconciliation

These automations allow fund managers to scale more efficiently and reduce overhead, freeing attention for strategic decisions.

Artificial Intelligence & Predictive Analytics

Some funds incorporate AI for forecasting market trends, rent growth, maintenance needs, tenant behavior, or optimal exit timing. Predictive models help managers anticipate changes in local economic conditions or property-level troubles, allowing proactive repositioning rather than reaction.

These advanced tools add sophistication to asset management and risk control for private real estate funds.

Benefits of Private Real Estate Funds

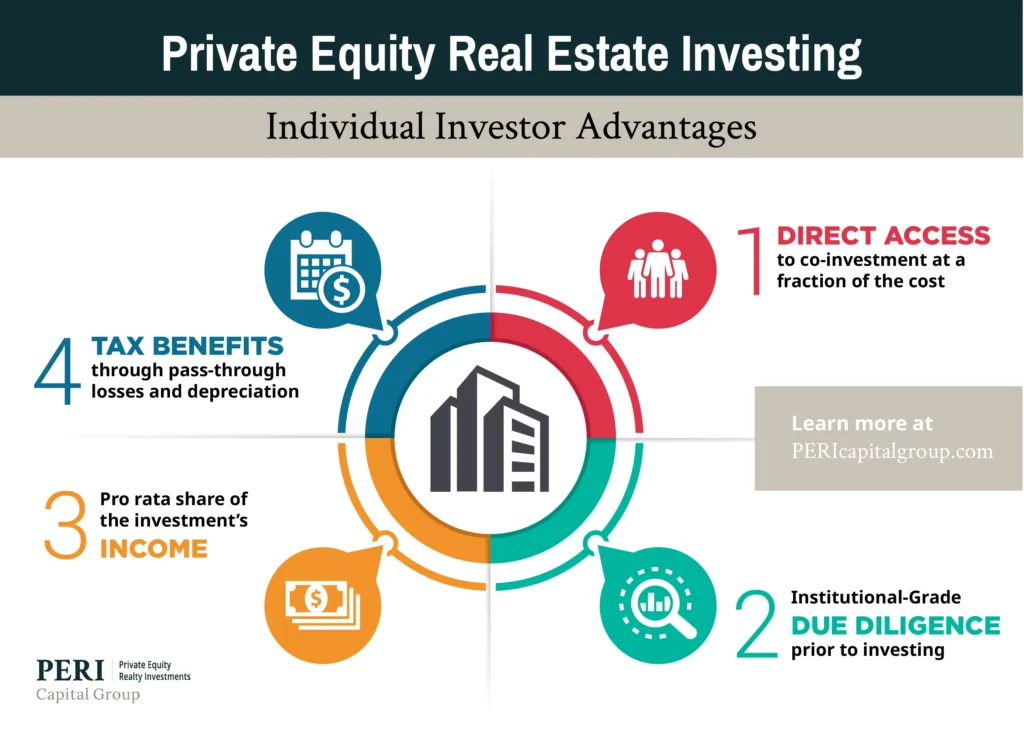

Private real estate funds offer multiple practical and strategic benefits to both investors and fund sponsors. Below are expanded explanations of those advantages.

Diversification and Portfolio Enhancement

Because private real estate often has low correlation with public equities or bonds, adding it to a multi-asset portfolio can enhance diversification. Over long periods, private real estate tends to produce returns that smooth out volatility compared to public markets.

For institutional investors, exposure to private real estate helps dampen equity risk, improve risk-adjusted returns, and provide alternative return streams not linked directly to stock markets.

Inflation Protection & Cash Flow Stability

Real estate leases often allow periodic rent adjustments, providing a hedge against inflation. Private real estate funds earning rental income can increase cash flows over time as property operating expenses and rents rise.

The stable income from property operations helps fund distributions, service debt, and deliver returns even in volatile economic environments.

Active Value Creation & Upside Potential

Because private real estate funds often involve active management (renovation, repositioning, redevelopment), there is scope for value creation beyond passive rent collection. Sponsors can unlock gains via operational improvements, cost efficiencies, lease-up strategies, or repositioning assets in changing markets.

This potential to enhance value is harder to replicate in publicly traded real estate, where much is already priced.

Access to Institutional Deals & Scale

For many investors, direct property ownership is impractical due to transaction scale, expertise demands, or zoning complexities. Private real estate funds allow smaller investors to participate in institutional-grade deals that they otherwise could not access.

Likewise, sponsors can raise large pools of capital to bid on major transactions, giving access to scale, deeper market penetration, or vertical integration opportunities.

Transparent Governance & Professional Management

Well-structured private real estate funds integrate governance, third-party audits, oversight, disclosures, and legal frameworks that improve alignment between investors and sponsors. Investors know how decisions are made, how returns are split, and what reporting they will receive.

This professionalism reduces agency risk compared to informal real estate investing.

Use Cases & Real-Life Applications

Below are scenarios in which private real estate funds provide solutions and compelling strategic advantages.

Use Case 1: Institutional Real Estate Allocation for Pension Funds

Problem: Pension funds need long-duration assets to match long-lived liabilities, but face limited yield in traditional fixed income.

Solution: Allocate capital to private real estate funds to earn stable cash flows, inflation protection, and return potential over a medium-to-long horizon. Funds manage acquisitions, operations, and exits on behalf of the pension.

Use Case 2: Regional Developers Scaling Beyond Local Markets

Problem: A local developer has strong skills but limited capital and geographic reach.

Solution: By partnering with or launching a private real estate fund, the developer can raise capital from investors to deploy into multiple markets, scale operations, and diversify risk across regions. The developer acts as sponsor and manager, while investors provide capital.

Use Case 3: Opportunistic Investing in Distressed Markets

Problem: After a market disruption (e.g., economic downturn, vacancy spike), many properties become undervalued or distressed.

Solution: Private real estate funds can raise opportunistic capital, acquire these assets at discounts, rehabilitate or reposition them, and exit once markets recover. The fund structure allows deployment of capital quickly across multiple assets.

Use Case 4: Mixed-Use Urban Redevelopment Projects

Problem: Urban redevelopment requires capital, coordination, and long-term vision.

Solution: A private real estate fund can assemble capital, acquire parcels, manage design, construction, leasing, and operational phases, enabling complex projects (residential + retail + office) that individual investors couldn’t undertake.

Use Case 5: Real Estate Credit as Complementary Strategy

Problem: Sponsor wants to diversify exposure rather than direct equity acquisition.

Solution: A private real estate debt fund invests in mortgages, bridge loans, and mezzanine financing for development projects. This provides yield with downside protection via senior claims and is a smoother return stream during periods when property values are flat or declining.

Risks, Challenges & Considerations

While private real estate funds offer many advantages, they come with significant risks:

- Illiquidity: Investors cannot freely redeem shares; capital is locked for years.

- Valuation uncertainty: Property appraisal, discounting, and regional market shifts can make valuations volatile.

- Leverage risk: High debt usage amplifies both gains and losses.

- Execution risk: Renovation delays, cost overruns, tenant turnover, or regulatory hurdles can damage returns.

- Alignment & conflicts: Misaligned incentives between GP and LP (excessive fees, related-party transactions) can erode investor returns.

- Market cycles: Real estate is cyclically sensitive to interest rates, supply/demand, and macroeconomics.

- Transparency and reporting: Without robust disclosure, investors may lack clarity on project-level performance.

To manage these, good fund design includes prudent leverage, clawback provisions, careful underwriting, diversification, independent audits, and alignment of incentives.

Frequently Asked Questions (FAQ)

Q1: How long is a typical private real estate fund lifecycle?

Most closed-end private real estate funds have a lifecycle of 7 to 12 years. During the early period, capital is deployed (acquisition, development), mid-term is operational, and later years focus on disposition and return to investors. This timeline aligns with property development, stabilization, and exit cycles.

Q2: Can private real estate funds offer liquidity?

Some funds include mechanisms for limited redemptions or tender offers, but in general, they remain illiquid. Even funds claiming liquidity must often queue redemption requests to protect existing investors from forced sales. The illiquid nature is a trade-off for higher potential returns and control.

Q3: How do investors evaluate a private real estate fund before committing capital?

Key evaluation criteria include sponsor track record, strategy clarity, alignment of interests, leverage policies, fee structure, governance, asset diversification, market insight, and projected returns under stress scenarios. Investors also scrutinize fund documents, waterfall structures, clawback provisions, and exit strategies.