Opendoor Property Trust I: Structure, Role & Real Estate Insights

When people talk about Opendoor, they usually mean the iBuyer platform that buys, renovates, and sells homes via a digital process. But behind the scenes, there are corporate entities, trusts, and legal structures supporting how Opendoor holds and manages real estate assets. One such entity is Opendoor Property Trust I. Understanding this trust is key to grasping how Opendoor’s business model works, how it handles inventory, and how value flows in the iBuyer ecosystem.

In this article, we delve deep into Opendoor Property Trust I: what it is, how it fits into the broader Opendoor operations, real-world use cases, the benefits and risks of such structures, technology’s role, and practical implications. We’ll also answer frequently asked questions to clarify common concerns.

What Is Opendoor Property Trust I and Its Role

Legal Identity and Functions

Opendoor Property Trust I is a legal entity registered in Arizona with an address in Tempe. It’s active under the name “OPENDOOR PROPERTY TRUST I.”

This trust or property holding entity appears in public project records as a property owner / public entity with involvement in real estate projects. Over recent years, it has undertaken multiple projects (reportedly 37 total, 6–7 in the past 12 months) as documented by project databases.

Its function is likely to hold, manage, or finance real estate assets (homes or portfolios) that the Opendoor platform acquires, renovates, or sells. It acts as a legal container for property ownership, liability isolation, and asset management within the overall corporate structure.

Relationship to Opendoor’s Core Business

To understand how the trust fits, recall Opendoor’s core business:

- Opendoor (or Opendoor Technologies Inc.) functions as an iBuyer: it makes cash offers to home sellers, acquires properties, does repairs/updates, then re-lists or sells them.

- As it acquires properties, it must hold title, manage maintenance, and market resale. These responsibilities often fall into subsidiary or trust structures rather than in the parent entity itself.

Therefore, Opendoor Property Trust I likely plays a role in:

- Holding title to property assets

- Receiving and disbursing capital for renovations

- Isolating risk (liabilities, lawsuits) from the main operating corporation

- Simplifying taxation or accounting in certain jurisdictions

Because many real estate and iBuyer firms use multiple legal entities to separate assets and reduce corporate exposure, the trust model is common in this business environment.

Operational Activity & Evidence of Projects

Project Footprint & Contractor Interaction

Project databases show that Opendoor Property Trust I has engaged in dozens of real estate projects across many states.

Some project metrics include:

- 39 total jobs historically

- 6–7 active projects in the past 12 months

- Operations across multiple states

- Occasional lien filings and delayed payments (though few in the last year)

These data suggest the trust is actively engaged in acquisition, rehabilitation, or property improvement projects. Contractors who bid or perform work see this entity as a counterparty.

Role in Contractor & Vendor Relationships

When Opendoor buys a home that requires repairs, it contracts with local vendors (roofers, plumbers, painters, electricians, restoration firms). Because the trust is nominally the property owner, it is often listed as the employer or payer in contracts, liens, and public project records.

This structure gives Opendoor flexibility. The operating company can focus on platform management, pricing, customer acquisition, and financing, while the trust handles property-level contracting and capital flows.

Example Use Cases & Illustrations

Below are some real-world style examples to show how Opendoor Property Trust I (or its functional equivalents) operate in practice.

Example 1: Post-Acquisition Renovation Oversight

When Opendoor purchases a house that needs repairs, Opendoor Property Trust I might take title, then issue work orders to contractors to refurbish the home (e.g., kitchen update, HVAC repair, landscaping). The trust pays the vendors, monitors quality, and ensures compliance.

This example shows how the trust acts as the central node for property rehabilitation, managing capital disbursements, contractor oversight, and quality assurance before the asset is resold.

Example 2: Title Holding and Risk Buffering

Another use case is holding title and insuring risk. Suppose a property is subject to legal claims, liens, or tenant disputes after acquisition. Because the trust is a separate entity, liabilities may be contained within that entity, protecting the operating company. This legal separation is standard practice in real estate investment structures.

By segregating properties under a trust, Opendoor mitigates risk to the parent corporation and simplifies risk calculations per asset.

Example 3: Portfolio Asset Liquidity & Financing

Opendoor sometimes accumulates inventory homes purchased but not yet resold. The trust can accumulate these properties as a portfolio, then refinance or securitize them, using the trust as the issuer or borrowing entity. This enables flexibility in funding and liquidity management.

In effect, the trust becomes a vehicle by which property inventory can be monetized, borrowed against, or transferred without directly involving the core company in each transaction.

Technology & Efficiency – Benefits in Operating Through a Trust

When a business like Opendoor uses legal entities such as Opendoor Property Trust I, technology plays an essential role in efficiency, tracking, and integration. Here are some of the advantages.

Integrated Property Management & Systems

The trust can integrate with property management software and enterprise systems that track each property, its status (under renovation, listed, sold), vendor payments, work orders, inspections, and more. This allows centralized dashboards across many assets.

Having a unique entity common across properties simplifies system design: properties held under “Trust I” can be grouped, filtered, monitored, and reported systematically, improving operational visibility and accountability.

Automated Capital Flow & Accounting

Because the trust handles property-level finance, technology can automate disbursement triggers: once a contractor finishes a milestone and passes inspection, payment is released. Invoices, lien waivers, and compliance documents can be processed electronically.

Such automation reduces delays, errors, and manual reconciliation tasks, thereby reducing overhead and speeding execution.

Asset Lifecycle Tracking & Analytics

Technology allows tracking of the entire life of each property from acquisition through rehab, holding, listing, and sale. Metrics like days on market, cost overruns, ROI per asset, and vendor performance can be measured.

When aggregated across a trust’s portfolio, these analytics drive strategic decisions: which property types, markets, or renovation models perform best. The trust structure centralizes all these assets under a consistent analytics domain.

Benefits & Advantages of Holding Real Estate via a Trust Entity

Using a trust entity like Opendoor Property Trust yields multiple practical benefits in real estate operations. Below are expanded explanations of these advantages.

Liability Isolation & Risk Containment

One of the primary benefits is liability isolation. If a property held by the trust is subject to litigation (e.g., structural defect, environmental issue, contractor dispute), the legal exposure is largely contained within that trust, protecting the parent company and other assets from cross-contamination.

Flexibility in Capital & Financing Structures

Trusts can issue debt, securitize assets, or act as collateral holders independently of the main operating entity. This flexibility allows financing on property-specific terms, rather than forcing all assets under one corporate umbrella.

Because the trust holds many individual assets, it can package pools of properties for sale or refinancing, enabling liquidity events or partial exits more cleanly.

Simplified Transfer & Sale of Assets

When a property is sold, the trust can transfer title without needing to disentangle it from the broader corporate structure. It simplifies transactions, particularly in multi-entity or multi-jurisdiction frameworks.

Trust-level ownership helps clarity in recording ownership, eases tax reporting, and local compliance in various states.

Clear Accounting, Reporting & Valuation

Separating real estate asset ownership into a dedicated trust makes financial statements cleaner. The trust’s assets, liabilities, and cash flows can be reported distinctly, enabling accurate valuation, transparency for investors, and more precise performance benchmarking.

Investors or stakeholders can assess the real estate holdings separately from platform or service operations.

Operational Efficiency & Scalability

By centralizing property-level functions (contracting, maintenance, inspections) inside a trust, procedures are standardized, oversight is streamlined, and economies of scale come into play. Scalability is enhanced because new properties are onboarded under an existing structure.

Use Cases & Practical Scenarios

Let’s examine how the concept of a property-holding trust like Opendoor Property Trust I addresses real operational or market problems.

Use Case 1: Rapid Acquisition & Renovation Pipeline

Problem: An iBuyer acquires dozens of homes weekly and needs to organize repair, inspection, listing, and sale workflows.

Solution: Use a property trust to absorb new acquisitions, route work orders, manage vendor relationships, and centralize renovation capital. This streamlines the onboarding of new inventory and reduces friction in scaling.

Use Case 2: Structural Risk Containment

Problem: A property with undisclosed defects or local regulatory violations attracts litigation.

Solution: Because that property is held in the separate trust, the risk is localized, preventing liability leakage into Opendoor’s main operations or other holdings. This containment safeguards the broader business.

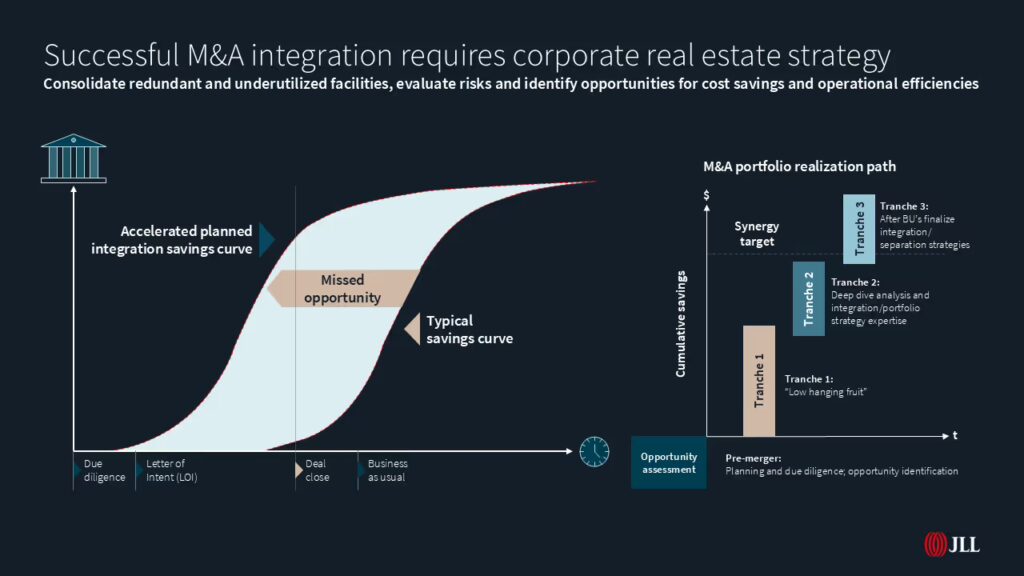

Use Case 3: Financing & Liquidity Event Facilitation

Problem: With many homes held unsold, capital is tied up, limiting acquisitions of new homes.

Solution: The trust can package part of the portfolio and refinance or issue debt. This unlocks liquidity, enabling more purchases or renovations without burdening the parent firm’s balance sheet.

Use Case 4: Performance Benchmarking & Investor Transparency

Problem: Investors or stakeholders want clarity on how the real estate assets perform, separate from platform services or marketing business lines.

Solution: Trust-level reporting allows presentation of metrics like gross margin, holding cost, renovation cost per unit, time to sale, and return on assets in a clear, standalone context.

Use Case 5: Jurisdictional / Tax Optimization

Problem: Real estate operates across many states with differing tax, reporting, or property registration rules.

Solution: Multiple trusts or local-trust structures (such as Trust I holding assets in certain jurisdictions) allow compliance and structuring tailored to each locality, while preserving uniform operational workflows.

Risks, Challenges & Considerations

While trust-based property holding yields many benefits, there are notable risks and complexities to manage.

- Administrative overhead: Each trust must maintain records, compliance, audits, and possibly state registration, which adds ongoing cost.

- Inter-entity coordination: Seamless operations require tight integration between the parent operating platform and trust-level entity (e.g., for capital allocation, decision authority).

- Valuation discrepancies: The trust’s assets may be valued differently than comparable assets held elsewhere, complicating consolidation or investor perceptions.

- Regulatory scrutiny: Because trusts can obscure ultimate ownership, regulators or stakeholders may demand higher transparency or oversight.

- Financing complexities: Lenders may require cross-collateralization or guarantees when dealing with trust structures, increasing the complexity of debt agreements.

Frequently Asked Questions (FAQ)

Q1: Why doesn’t Opendoor just hold all properties under its main corporate entity, rather than using a trust?

Holding properties in a trust helps isolate risk, simplify property transactions, and manage liability more cleanly. It also enables trust-based financing, clearer reporting, and operational compartmentalization rather than exposing the parent company to full real estate risk.

Q2: Does Opendoor Property Trust own all properties Opendoor acquires?

Not necessarily all. Opendoor likely uses multiple holding entities or trusts, possibly segmented by geography or property class. Trust I is one such entity, likely holding a subset of properties or projects in certain areas.

Q3: Can an investor or third party gain visibility into Trust I’s assets and performance?

Some visibility exists via project databases and public filings, such as contractor job histories or state records. But full internal performance (e.g, profit margins, detailed ROIs) is typically internal to the company unless disclosed in investor reports or financial statements.